Photo Credit: RIAA

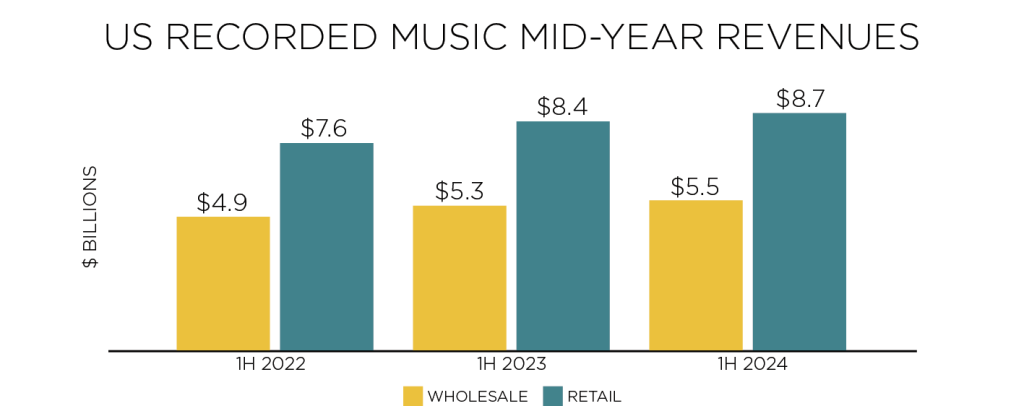

The RIAA has released its mid-year report for 2024, revealing that U.S. recorded music revenues rose 4% to $8.7 billion in estimated retail value. That’s a record sum, according to the major label trade group, though paid subscription accounts improved just 2.7% year-over-year.

Recorded music revenues in the United States have grown for nine straight years, according to Recording Industry Association of America (RIAA) stats dating back to 2016. Digital streaming has now entered its third decade in the US, with paid music streaming subscriptions remaining the driving force of the industry.

By the first-half numbers, streaming now delivers more than two thirds of total revenues (84%), averaging 99 million plans over the first half of the year. The RIAA notes that this figure is easily over 100 million individual users as household plans such as Spotify’s family offering count as a single subscription in its data.

Photo Credit: RIAA

These are bullish numbers, and growth is always great. But do they demonstrate the presence of a streaming slowdown?

Picking the data apart, revenues from paid subscription services overall grew 3.8% in the first half of 2024—reaching $5.7 billion and accounting for 78% of streaming revenues. Limited-tier subscriptions actually fell 4% to $503 million and include services such as Amazon Prime, Pandora Plus, and music licenses for streaming fitness services like Peloton.

Zeroing in on one of the most important stats: ‘Paid Subscriptions,’ which refer to typical subscription accounts from the likes of Spotify, Apple Music, Amazon Music, and others, bumped a modest 2.7% year-over-year, according to the RIAA figures, suggesting a plateau ahead.

Meanwhile, advertising supported on-demand services like YouTube, Spotify, Facebook, and others have grown at a slower pace than recent years—up only 2% to $899 million. These ad-supported services contributed only 10% of total H1 2024 recorded music revenues.

Photo Credit: RIAA

Digital and customized radio grew 2% to $672 million in 2024 with SoundExchange distributions for revenues from SiriusXM and internet radio stations as well as direct payments from other similar services. SoundExchange distributions grew 4% to $517 million, while other ad-supported streaming revenues of $155 million were down 3%.

Photo Credit: RIAA

Overall revenues continue to stand on a strong and wide foundation that music companies have worked for decades to build. Amazingly, a format that peaked nearly 50 years ago is still intermingling with streaming.

Vinyl records alone grew 17% this period and are on pace to break the billion-dollar barrier by the end of 2024. The RIAA says this report comprises the broadest range of revenue categories ever—from traditional sync deals and ad-supported services to fitness platforms like Peloton—as well as newly emerging short-form video apps.

Revenues from physical music formats continued to outpace all other major forms of recorded music. Total physical revenues of $994 million were up 13% versus the prior year. For the fourth consecutive year, vinyl outsold CDs in units (24M vs. 17M) Revenues from CDs were relatively flat at just $237 million in 2024 so far.

Digital downloads have declined in share for the 14th straight year, accounting for just 2% of U.S. recorded music revenues. (A not-so-fun fact here is that TikTok was paying Universal Music Group less than that sum in total revenues prior to the major label’s catalog pullout.)

Both digital album sales and individual track sales were down $88 million and $82 million respectively.