Photo: Logan Weaver

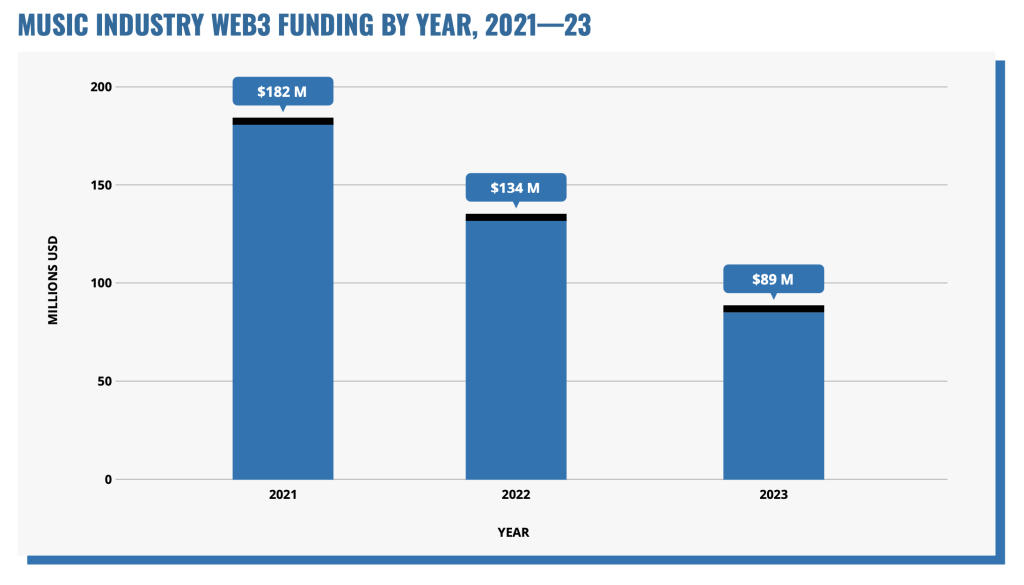

Yesterday, Digital Music News unearthed a shocking statistic in our latest DMN Pro Weekly Report: music-focused Web3 funding had plunged 51% between 2021 and 2023. But why are there so many green shoots in January if this space is crashing?

For signs of life in the music-focused Web3 space, look no further than DMN’s inbox this morning. Top of the pile? An alert from Warner Music Group’s ‘Web3 Music Accelerator,’ a joint effort involving Polygon Labs. DMN first reported on WMG’s Web3 incubator last summer, and several months later, some early hopefuls are being announced.

According to the companies, the aim of the incubator is ‘to power the next generation of innovation at the intersection of Web3 and music’ — and most likely, take a healthy cut of any successes.

(Incidentally, Universal Music Group is also prepping its own incubator — dubbed ‘UMusicLift’ — though it’s unclear if Web3 will be part of the initial portfolio of supported companies. The initiative is coming out of UMG’s Digital Innovation team and will serve as a new online hub dedicated to ‘supporting the next generation of diverse, music-related startups and entrepreneurs who aim to accelerate the next wave of digital transformation.’)

Interested in a serious deep-dive into Web3 startups and funding in the music industry? Check out our latest DMN Pro research report on Web3 successes, failures, pivots, and funding levels — including a rundown of every company making a play for this space.

Not a DMN Pro subscriber? Change that immediately!

So far, WMG’s ‘winners’ are merely ‘hopefuls,’ and both have celebrity backers — which isn’t necessarily an indicator of eventual success (or, for that matter, failure). MITH is focused on fan engagement, with Jack Harlow, Emilia Clarke, and Halle Berry offering some celebrity sizzle to the platform. MITH plans to give artists AI-driven data and analytics from ‘artist-owned first-party data on their audiences,’ with Jack Harlow among the first artists to benefit.

Also on WMG’s ‘most likely to succeed’ list is Muus Collective, which features Paris Hilton and celebrity gamer Felicia Day on the board. The company’s rewards-focused community approach focuses on ‘fashion-centric experiences’ across mobile games, digital collectibles, and broader entertainment. What that means in reality remains to be seen, though expect a heady explosion of gaming, music, and fashion.

“Music and fashion have long been inextricably linked, and we see a wealth of opportunity to explore this relationship in a gamified virtual environment where players interact and express themselves with both music and fashion,” relayed Amber Bezahler, a cofounder of Muus Collective.

Music Web3 funding, 2021-2023 (Source: DMN Pro Music Industry Funding Tracker)

If that sounds eye-roll-worthy, we get it. After all, investors have splurged over $400 million on music-focused Web3 plays since 2021, with sub-categories like NFTs, the metaverse, cryptocurrency and blockchain. Many of those startups have yet to produce a proof of concept – or are simply dead.

In fact, we found a few dead bodies after simply shaking our editorial stick. Chief among the moribund is the Quincy Jones-backed OneOf, a self-described ‘NFT platform built specifically for the music vertical.’ OneOf announced a $63 million raise in 2021 and another $8.4 million round in 2022. But as we’ve exhaustively reported, several customers claim this company is ghosting its customers.

Several maintain that the formerly high-flying company has failed to honor promises made ahead of token drops, such as the development of a Notorious BIG metaverse. Perhaps worthless coins are a cliché at this point, but several customers holding tokens are still wondering what happened on OneOf’s Discord server.

Meanwhile, music NFT platform Stems, which raised $4 million in 2022, looks to have gone dark, as we first reported last year. Predictably, funding has dipped in the music non-fungible token sector and seemingly all but ceased for industry companies that deal solely in NFTs.

Sounds bleak, except for a significant number of Web3 plays that are quietly pivoting.

Topping that list is Limewire, which quickly plunged into — then out of — the murky waters of Web3. Ahead of its 2022 relaunch, the face-lifted LimeWire was billed as a “one-stop marketplace for artists and fans alike to create, buy and trade NFT collectibles with ease.”

The platform then scored a $6.5 million raise in May 2023 before shifting into the burgeoning generative AI sphere, a move set in motion by the September buyout of BlueWillow.

Which brings us to January of 2024.

Despite the seemingly dour drop in funding since 2021, 2024 has delivered three unexpectedly large Web3 rounds, according to DMN Pro’s Music Industry Funding Database. That includes three multimillion-dollar raises for Medallion (a $13.7 million Series A), Tune.fm ($20 million), and TRAX (a $2.9 million “decentralized funding round”). Those rounds are healthy, though investors are likely looking for a more focused and disciplined approach to Web3 in 2024.

Like we said, it’s complicated.