Paid only. Lower subscriptions. No IPO. And, a small profit. What could Spotify and other streaming music services stand to learn from Napster?

Last month, Spotify reported a new record in its Q2 2018 financial report.

The Swedish streaming platform had reached over 83 million subscribers worldwide. Between January and June 2018, the company added 2 million subscribers each month. Premium revenue also reached $1.34 billion, up 27% year-over-year.

Yet, the company also revealed that its massive size continues to be its Achilles’ heel.

Average revenue per user (ARPU) totaled $5.40, down 12% year-over-year. So far this year, the company has lost $584 million. And, it remains on track to lose over $1 billion at the end of 2018.

A distant rival, however, has proven that streaming music can be successful — if world domination isn’t part of the plan.

How to turn a profit in streaming music after years of losses, by Napster.

Several weeks ago, RealNetworks shared its Q2 2018 financial results. The company owns a 42% stake in Rhapsody, which bought Napster from Best Buy in 2011. It later rebranded itself as Napster 2 years ago.

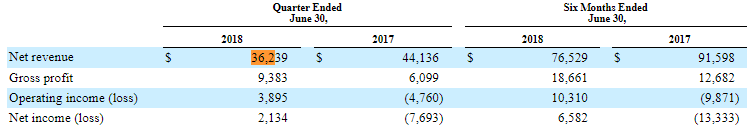

In the second quarter of 2018, Napster reported $36.2 million in revenue, down 17.9% from $44.1 million in the same period last year. RealNetworks reported Napster had a gross profit of $9.4 million, up 53.8% year-over-year. Operating income reached $3.9 million, up over losses of $4.8 million in Q2 2017.

Net income reached $2.1 million, up from $7.7 million in net losses in Q1 2017.

For the six months ended June 30th, 2018, Napster brought in $76.5 million in revenue, down 16.5% from $91.6 million in the first half of 2017. Gross profit, however, rose 47.1% to $18.7 million. Operating income also saw a huge increase, reaching $10.3 million over operating losses of $9.9 million in H1 2017.

Net income reached $6.6 million, up from severe losses of $13.3 million year-over-year.

So, how did they manage it?

RealNetworks doesn’t share any subscriber metrics, making it difficult to confirm how many subscribers Napster actually has. The company last confirmed its streaming music service had 3.5 million subscribers in late 2015. Midia Research reported 4.5 million users in January 2017.

Yet, we know the service has several key points in its favor.

First, Napster doesn’t offer a free, ad-supported tier, unlike Spotify, Deezer, and Pandora. So, it doesn’t have to pay out nor depend on advertising revenue. This may allow it to remain the undisputed ‘king’ in terms of streaming music payouts.

According to our ongoing royalty canvas, Napster reportedly pays artists $0.01682 per stream. In turn, Apple Music pays $0.00783, Amazon $0.0074, and Spotify $0.00397. Pandora and YouTube remain the worst payout ‘offenders’ at $0.00134 and $0.00074 per stream, respectively.

Second, with fewer subscribers, Napster likely has to pay less in operating costs. Spotify, on the other hand, has a growing number of subscribers. Because of this, the company’s operating losses continue to balloon. In Q2 2018, Spotify’s operating losses jumped to $105 million, 7% of its total Q2 2018 revenue.

Third, Napster remains a partial subsidiary of RealNetworks. So, it doesn’t have to depend directly on outside investments to continue operating, unlike Spotify. For the first half of 2018, Napster’s parent company reported $25.6 million in gross profit. Spotify has yet to post a profit after 10 years.

Yet, Napster’s not out of the clear.

The streaming music service’s revenue has fallen substantially in the past several years. That’s due to increasing competition. And this space may exclusively belong to the elephants in the future.

In 2011, the service reported $127.2 million in revenue. That figure grew to $143.7 million in 2012 and fell to $140.6 million a year later. Between 2014 and 2016, revenue exploded to $173.5 million, $202 million in 2015, and $208.1 million, respectively.

Yet, prior to Q4 2018, Napster had failed to turn a profit. Once Mike Davis stepped down as CEO, RealNetworks executive Bill Patrizio took over.

Under Patrizio, the service has now reported 3 straight quarters of profits – Q4 2017, Q1 2018, and Q2 2018.

Aiming low means it will ultimately benefit in the long run.

At the Midem conference in June, Patrizio explained his vision for Napster. The company doesn’t plan to compete directly against Spotify and Apple Music. Instead, it’ll aim for the ‘niche’ market. Namely, offering white-label streaming for global brands.

Patrizio explained,

“Because of the growth and the diversification, we believe other companies – other enterprises – who have a manifest destiny to participate in music, will find the music business attractive and will inevitably make choices about whether to build the business themselves or potentially partner.”

Speaking about Napster’s long-term future, he added,

“The market will still be dominated 80% we believe by those dominant players: Spotify, Apple… We expect it’s going to be a market size of about $7bn, moving towards potentially $20bn or $25bn… and that increasingly leaves opportunity for other players to participate.

“Even a 20% slice of a $20bn market is a $4bn market… and that’s what we’re going to focus on… This is not going to be about just bringing to market the $9.99 product that we have today. This is going to be about innovation, about new forms of experience.”

So far, that strategy has worked.

Apple, in turn, doesn’t have to worry about burning money with its streaming music service. As former Head of Apple Music Jimmy Iovine explained, the company doesn’t depend on streaming to turn a profit. Apple has many more financially successful products, including the iPhone, HomePod, iPad, and services, including Apple Pay. Apple Music remains a way to hook consumers into its walled ecosystem of products and services.

Yet, Spotify doesn’t have anything else but streaming. And, to remain on top, it’ll continue burning through investors’ millions.

Maybe the Swedish streaming music platform could stand to learn from Patrizio’s example with Napster.

Maybe.

Featured image by midem (YouTube screengrab).

They are profitable not because of streaming but because they sell corporate partners a B2B white-label service.

“Check your facts yo

They are profitable not because of streaming but because they sell corporate partners a B2B white-label service.”

^^^^^^^^^^

this

Also, what does this: “Third, Napster remains a partial subsidiary of RealNetworks. So, it doesn’t have to depend directly on outside investments to continue operating, unlike Spotify.”

have to do with Napster’s “profitability”???? What does a) being partly owned by Real Networks, vs. b) being a public company with institutional investors have to do with the core business model and it’s profitability? Are you saying that Spotify has to service debt that Napster doesn’t?

Be clear and be specific.

Someone should give me a couple hundred million dollars to burn through and I’ll make a profitable digital music company too. And it won’t take me 17 years and hiring and firing 500 people either.