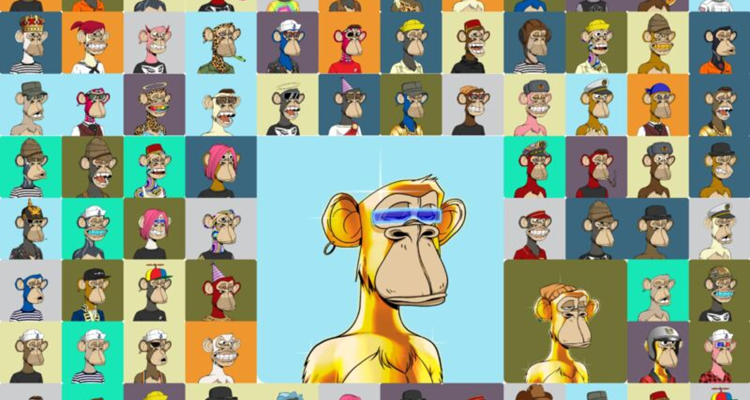

Class action Bored Ape NFT lawsuit against Justin Bieber, Snoop Dogg, Post Malone, and Madonna expands to include Sotheby’s.

A lawsuit filed by investors who regret their purchase of a Bored Ape Yacht Club (BAYC) NFT during the height of their craze in 2021 has now expanded to include the Sotheby’s auction house as a defendant. When a Sotheby’s auction misled investors by giving the Bored Ape NFTs “an air of legitimacy” to “generate investors’ interest and hype around the Bored Ape brand,” the lawsuit alleges.

The lot consisting of 101 Bored Ape NFTs sold in the Sotheby’s “Ape In!” auction for $24.4 million in September 2021, well above the pre-auction estimates of $12 million to $18 million. According to data from CoinGecko, a Bored Ape NFT can be purchased today for about $50,000 in cryptocurrency.

The inflated prices at the Sotheby’s auction “was rooted in deception,” claims the lawsuit filed in US District Court for the Central District of California, as the buyer was not disclosed at the time of the auction to be now-disgraced cryptocurrency exchange company FTX.

“Sotheby’s representations that the undisclosed buyer was a ‘traditional’ collector had misleadingly created the impression that the market for BAYC NFTs had crossed over to a mainstream audience,” the lawsuit furthers, saying that investors bought the NFTs “with a reasonable expectation of profit from owning them.”

Previously, investors sued Bored Ape creator Yuga Labs and four company executives, along with various celebrity promoters, including Snoop Dogg, Justin Bieber, Madonna, Jimmy Fallon, Kevin Hart, Gwyneth Paltrow, Serena Williams, and Steph Curry. The initial class action lawsuit was filed in December 2022, with Sotheby’s added as a defendant in an amended complaint submitted on August 4.

The amended lawsuit claims that Yuga Labs colluded with Sotheby’s auction house to run “a deceptive auction,” with the winning bidder FTX described during a Twitter Spaces event as a “traditional” collector. Only later was it revealed that the buyer was the now-bankrupt crypto exchange platform FTX, whose founder Sam Bankman-Fried is in jail awaiting trial on criminal charges.